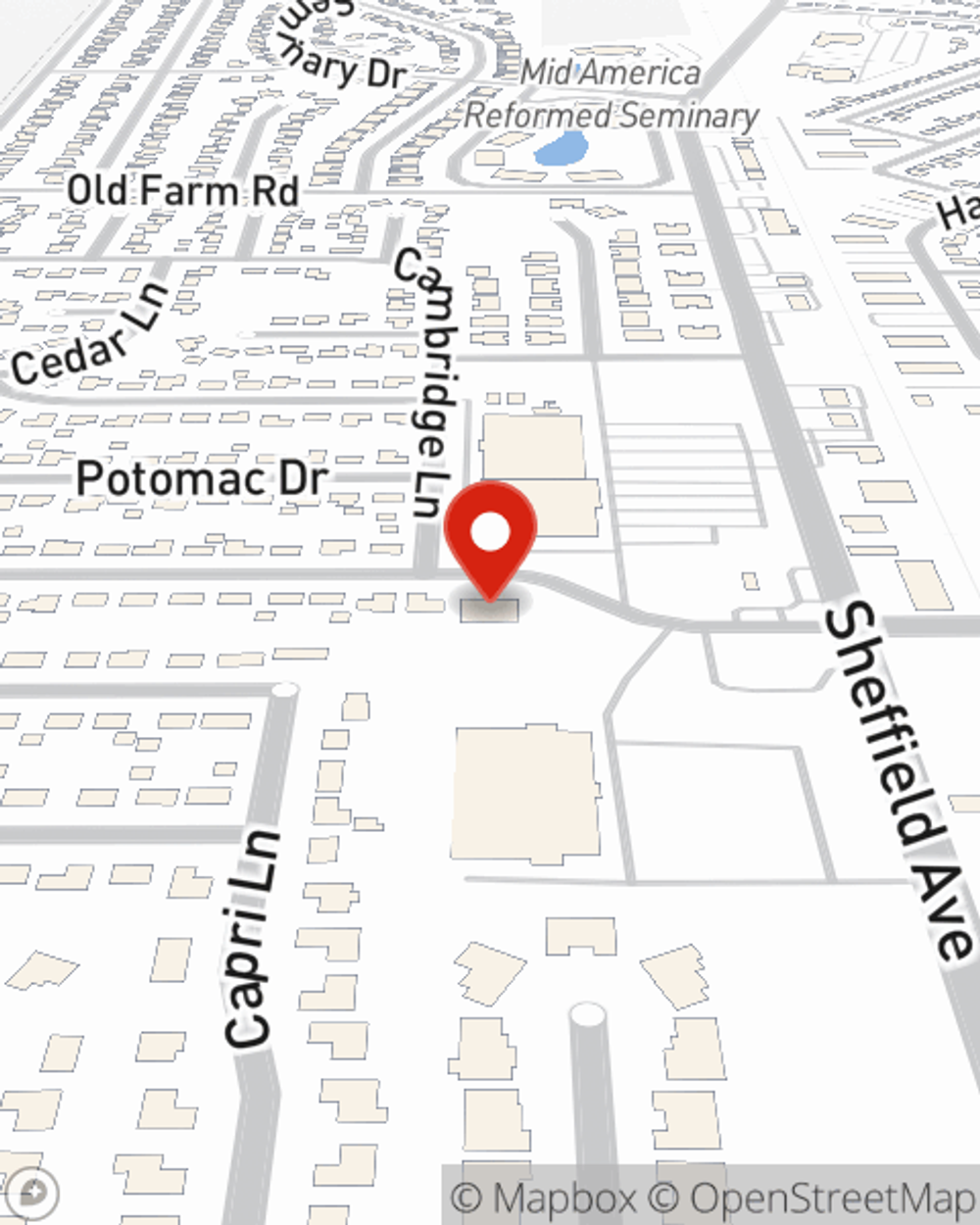

Life Insurance in and around Dyer

Protection for those you care about

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

People sign up for life insurance for many different reasons, but the primary reason is typically the same: to ensure a certain financial future for your loved ones after your passing.

Protection for those you care about

Life won't wait. Neither should you.

Wondering If You're Too Young For Life Insurance?

Service like this is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the worst comes to pass, Marlene Moore stands ready to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

Looking for a life insurance option that even those who thought they couldn't qualify could benefit from? Check out State Farm's Guaranteed Issue Final Expense. It can prove useful to cover final expenses, such as medical bills or funeral costs, without weighing down your loved ones. Contact your local State Farm agent Marlene Moore for help with all your life insurance needs.

Have More Questions About Life Insurance?

Call Marlene at (219) 513-9911 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Can you really save if you choose to bundle insurance?

Can you really save if you choose to bundle insurance?

Bundling insurance, such as auto and home insurance, can be a great way get discounts — but that’s not all! We share some insights about why bundling makes sense for savings and more.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Marlene Moore

State Farm® Insurance AgentSimple Insights®

Can you really save if you choose to bundle insurance?

Can you really save if you choose to bundle insurance?

Bundling insurance, such as auto and home insurance, can be a great way get discounts — but that’s not all! We share some insights about why bundling makes sense for savings and more.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.